does shopify provide tax documents

By tracking your tax responsibility daily you can. The earlier deadline gives partners a chance to receive Schedule K-1s before the personal tax return due.

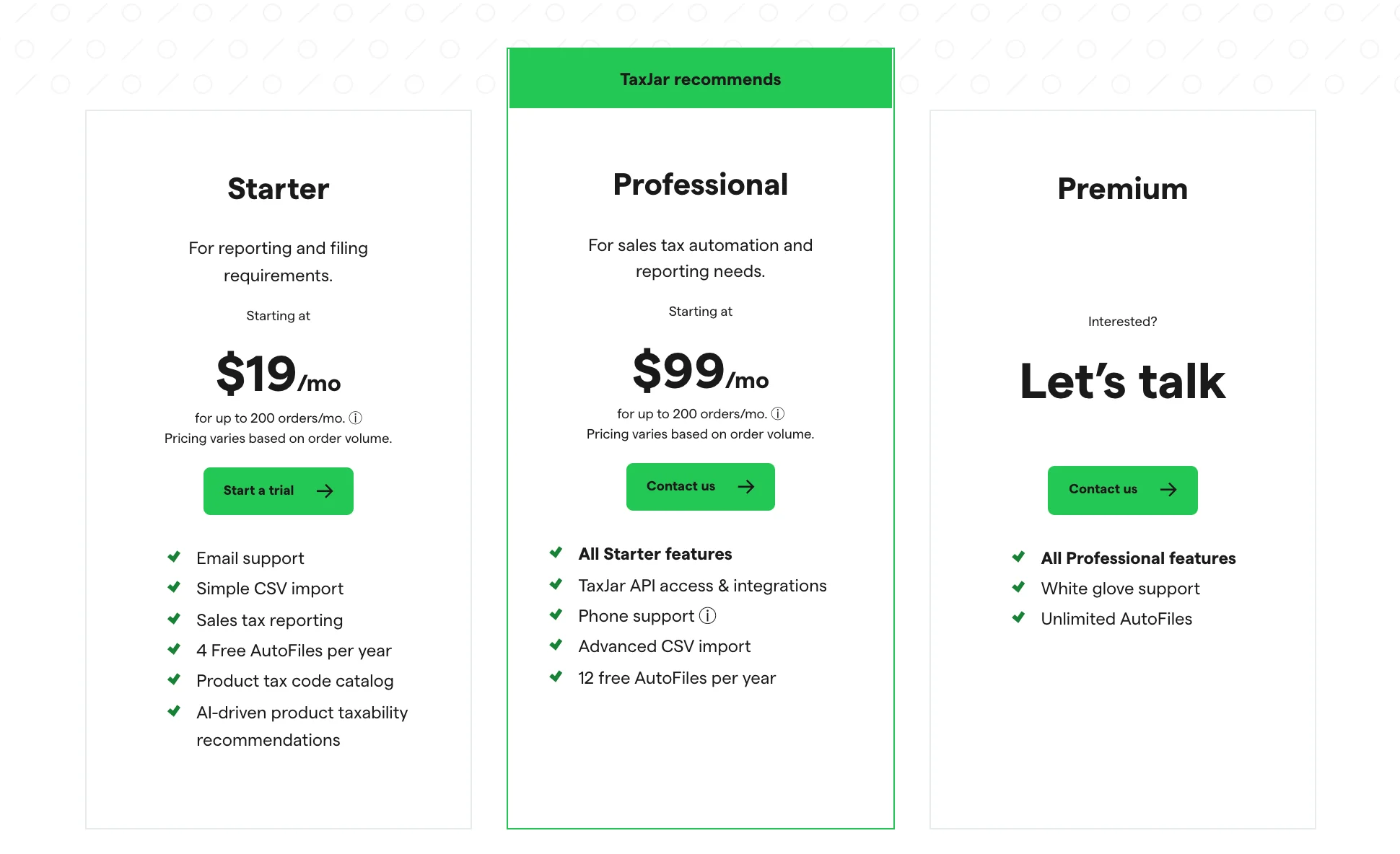

Sales Tax Liability 5 Things To Know For Your Shopify Store Taxjar

1099s are available to download in the payments.

. The platform provides sellers with handy Shopify tax documents that show you how much the site has collected in taxes on. Form 1040 for income tax returns. It is required that Shopify Payments report your sales to the tax administration.

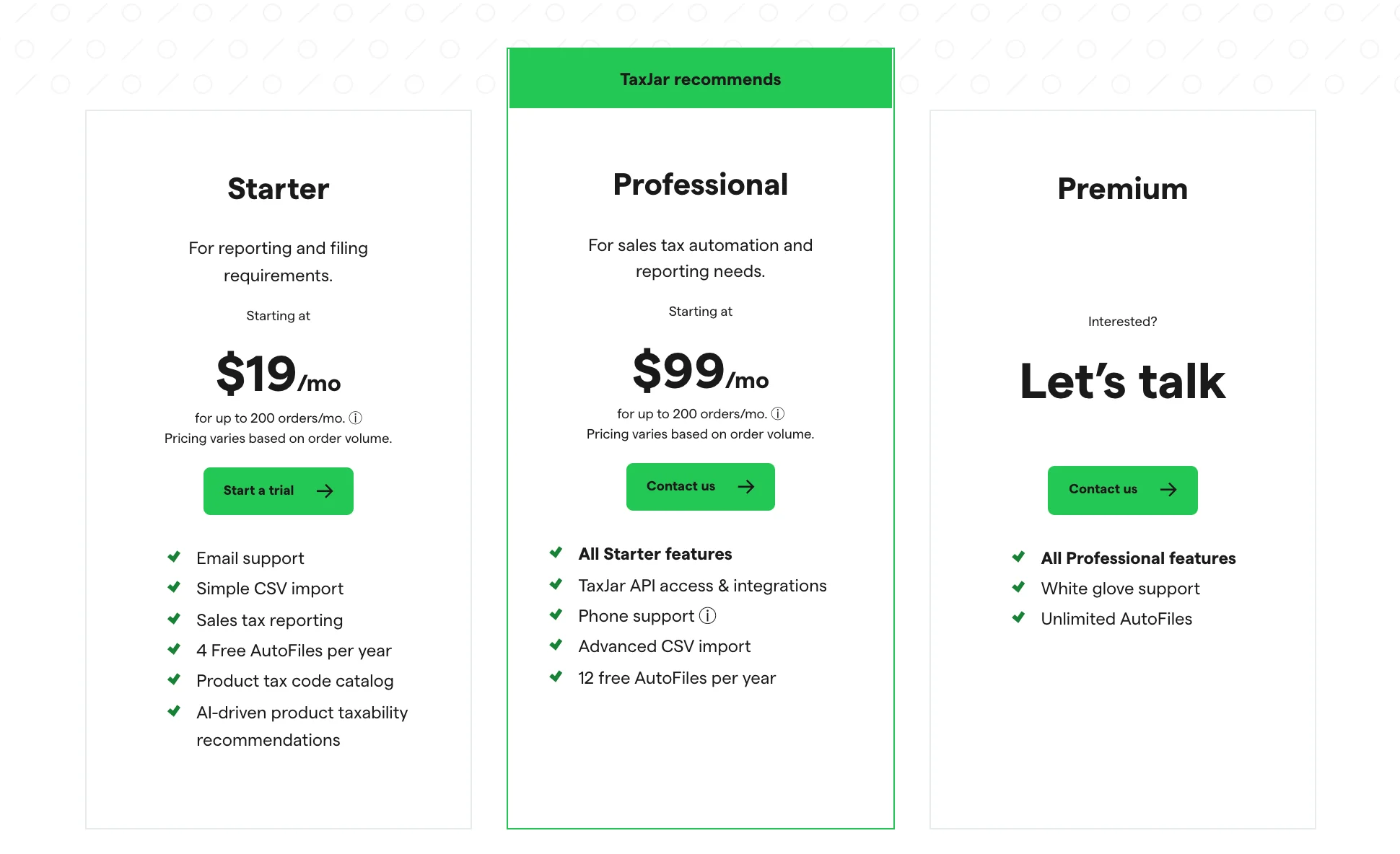

Ad Spend less time on sales tax with a free trial of the Avalara AvaTax plugin for Shopify. Does shopify provide tax documents Sunday February 27 2022 Edit. Yes Shopify reports most account owners business transactions to the IRS every year in a form called the 1099-K.

Schedule C if you are a sole proprietor and have income or losses to report. While tax laws and regulations vary based on factors like location and what youre selling Shopify makes it easy for you to manage your taxes. Does Shopify send tax forms.

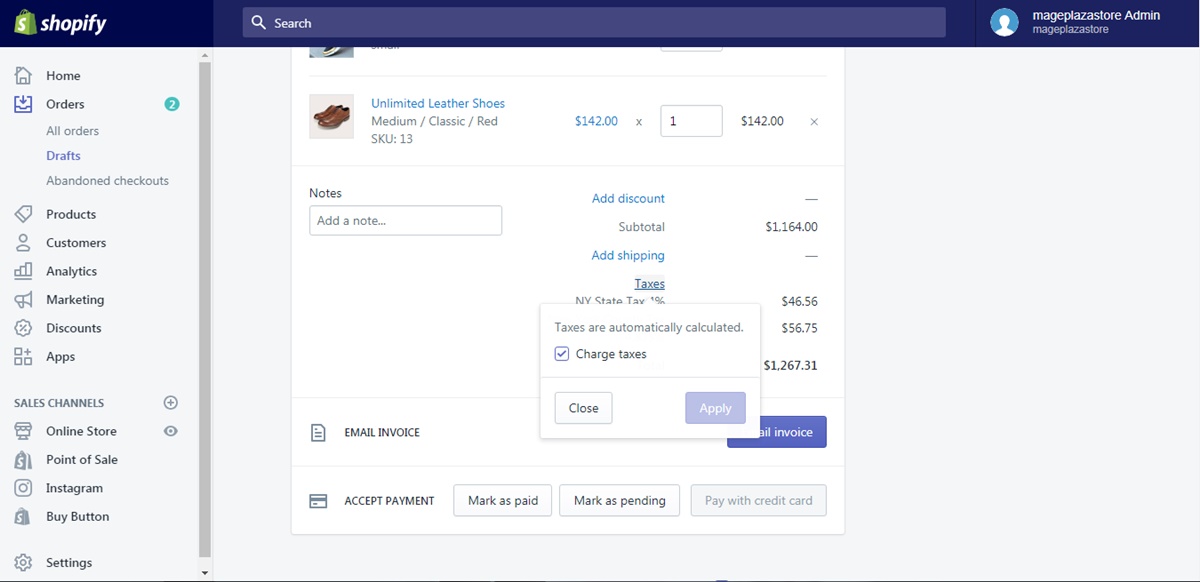

Shopify doesnt file or remit your sales taxes for you. Our Shopify sales tax solutions can make paying your taxes easy. Shopify helps to automate charging sales taxes but Shopify doesnt remit or file your taxes for you.

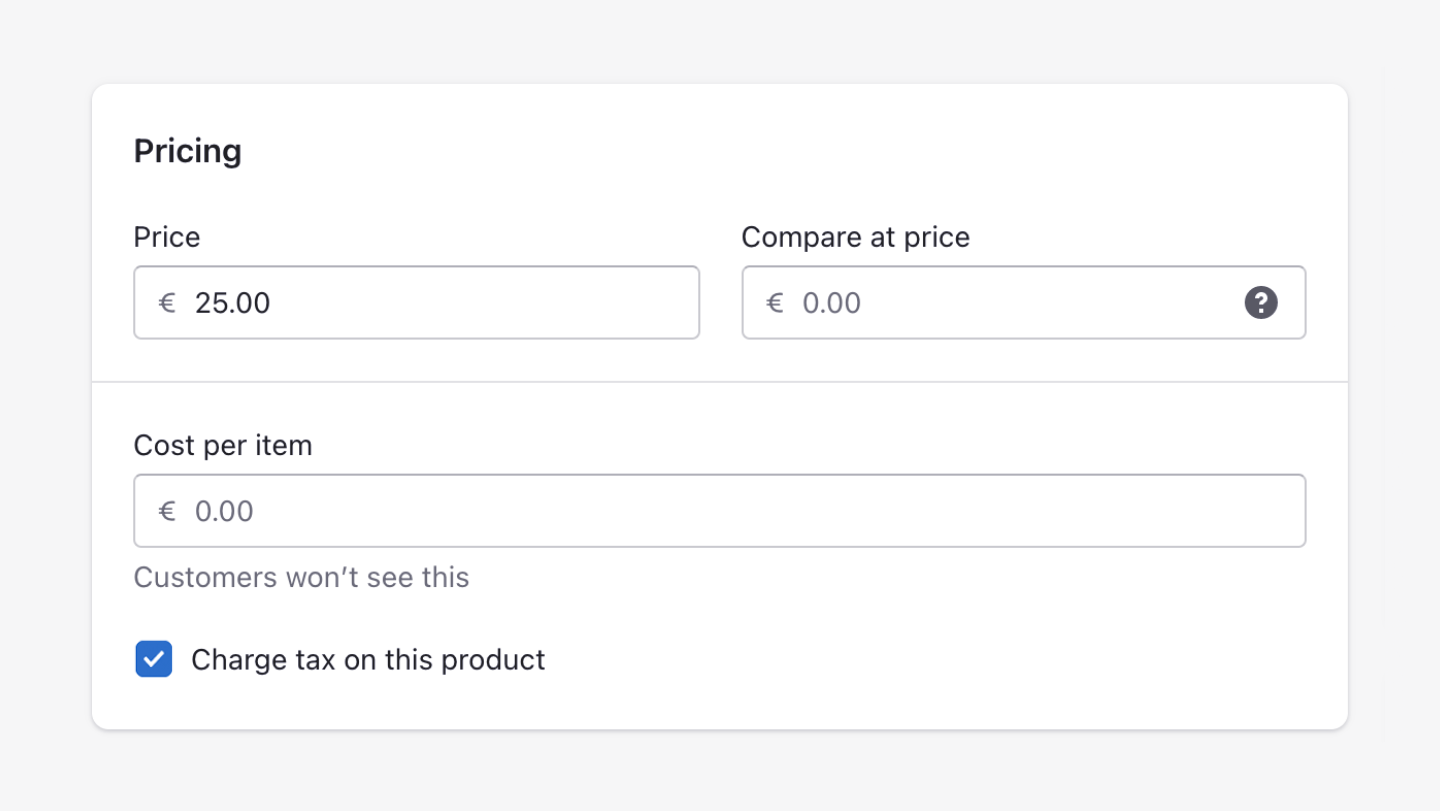

You might need to register your business with your local or federal tax authority to handle your sales tax. Yes Shopify does provide sales tax reports. You might need to register your business with your local or federal tax authority to handle your.

The calculations and reports. With that said its worth noting that Shopify does. This is the same form youd get if your customers or clients.

In the Shopify Payments section click Manage. You might need to register your business with your local or federal tax authority to handle your. Tax reports The Taxes finance report can provide a summary of the sales.

For calendar years prior to 2022. Does Shopify Provide Tax Documents. Does Shopify provide tax documents.

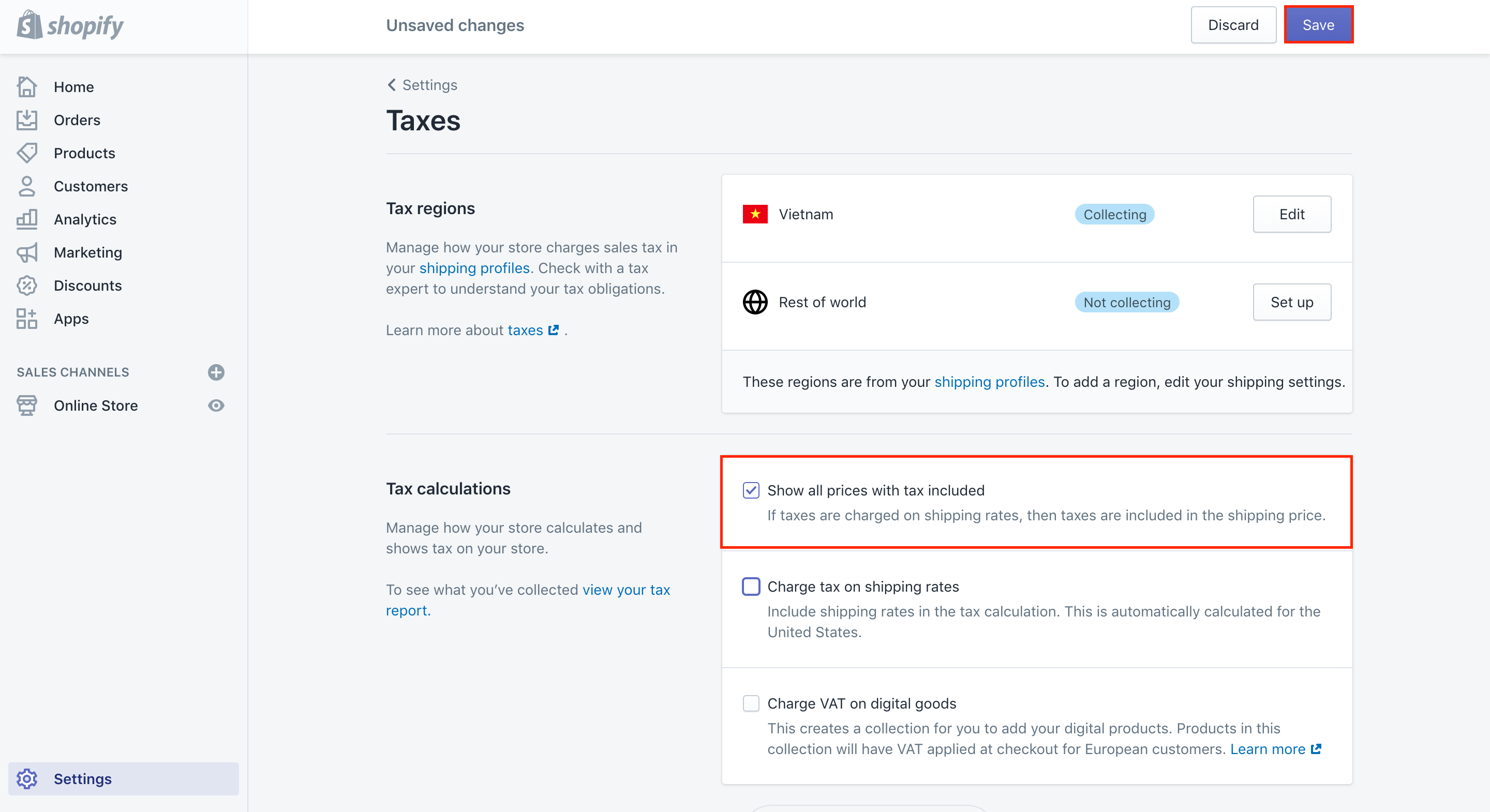

Shopify doesnt file or remit your sales taxes for you. 1099-K issued by Shopify for merchants turning over 20000 a. In the Tax calculations section click Charge VAT on digital goods.

You might need to register your business with your local or federal tax authority to. How much you actually pay will depend on. Shopify doesnt file or remit your sales taxes for you.

From your Shopify admin go to Settings Taxes and duties. Does Shopify provide tax documents. Avalara AvaTax has a prebuilt plugin for Shopify to make sales tax easier.

Shopify store taxes are part of being a Shopify owner. You can follow this guide to determine where in the United States you might be. As you set up taxes you can access and review your settings on the Taxes and duties page in your Shopify admin.

Shopify will issue a 1099 to store owners and the IRS when a store hits 200 transactions and 20K in sales. On your Collections page click Digital Goods. Ad Spend less time on sales tax with a free trial of the Avalara AvaTax plugin for Shopify.

Home documents does tax wallpaper. Shopify doesnt file or remit your sales taxes for you. This is an essential tool for small businesses that make sales in multiple states.

Does Shopify provide tax documents. The 1099-K form is submitted by Shopify to the IRS if you are using Shopify Payments and meet the following requirements. If a Shopify store sells 200 transactions it will receive a 1099 from Shopify along with a copy of a tax ID number from the IRS.

However depending on your local jurisdiction tax reporting requirements could vary significantly. March 15 is the deadline to file individual and partnership tax returns. Pin On Products Will I Be Getting A 1099 K Form If So When.

Every year you should be setting aside at least 30 for your total tax liability. Under Payout schedule in the Payout details section check or uncheck Enable notifications. Set up fraud prevention.

Avalara AvaTax has a prebuilt plugin for Shopify to make sales tax easier.

Usa Etsy Shopify Bookkeeping Spreadsheet Automated From Csv Etsy Uk In 2022 Spreadsheet Template Bookkeeping Templates Bookkeeping

How To Charge Sales Tax In The Us 2022

Why Are Taxes Missing On My Shopify Orders And Invoices Sufio For Shopify

How To Start A Shopify Store Infographic Shopify Tutorial

How To Charge Shopify Sales Tax On Your Store Aug 2022

Usa Etsy Shopify Bookkeeping Spreadsheet Automated From Csv Etsy Uk Bookkeeping Spreadsheet Template Spreadsheet

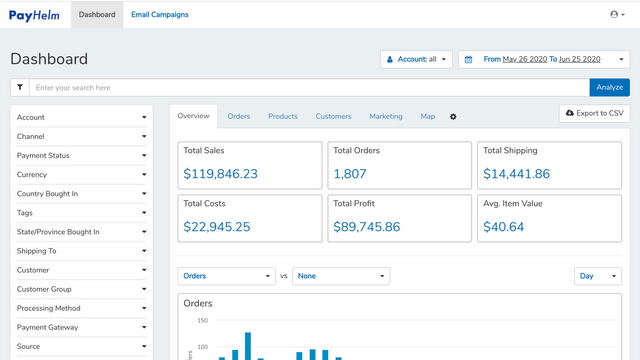

Accounting Tax Data Reports Accounting For Sales Orders Inventory Tax Profits More Shopify App Store

Usa Etsy Shopify Bookkeeping Spreadsheet Automated From Csv Files Sales Income Fees Expenses Excel Accounting Template With Sales Tax

Sales Tax Liability 5 Things To Know For Your Shopify Store Taxjar

How To Charge Taxes On Shopify Store

How To Add Or Remove Taxes On Shopify In 5 Easy Steps

How To Charge Shopify Sales Tax On Your Store Aug 2022

Shopify Sales Tax Setup Where And How To Collect Ledgergurus

Hire The Best Shopify Developer For Your Brand Development Shopify Hiring

How To Charge Sales Tax In The Us 2022

How To Charge Sales Tax In The Us 2022

How To Update Your Billing Period On Shopify Accounting Information Bank Account Accounting

How To Deactivate A Fulfillment Service On Shopify Fulfillment Services Deactivated Fulfillment

Take A Look At The Sales Volume Of Shopify Across All Merchant Stores The Total Dollar Value Of Orders Processed On The Value Added Tax Online Sales Marketing